Marketing Strategy of Standard Chartered Bank Saadiq Platinum Credit Card.

By 1948, the Standard Chartered Bank was operating in what is now Bangladesh, and over time, it evolved into a trusted name not just here, but worldwide. It first made its mark back in 1947 in Chittagong. It’s involved in all sorts of banking services retail, corporate, institutional, trade finance, and even cutting-edge digital platforms. But the focus today? Their Saadiq Platinum Credit Card a product that blends modern banking with Islamic principles.

Let’s be honest: people sometimes overlook how important banks really are. But in a growing economy like Bangladesh’s, banking is not just a background activity it’s central to business growth, consumer empowerment, and infrastructure development.

More businesses are opening their doors. New services launch every month. And what do they all need? Fast, reliable financial solutions and banks that understand local and global needs. In this context, information becomes more than just numbers; it’s the backbone of every business decision.

Business Activities of Global Standard Chartered bank.

Standard Chartered isn’t just a local player. It’s got reach real, global reach. Sub-Saharan Africa, Standard Chartered Bank operates in countries like Kenya, Zambia, Zimbabwe, and Ghana. Meanwhile, the Gulf and South Asia operations are coordinated right out of Dubai, giving it both regional focus and strategic balance.

| Report Title : | Marketing Strategy of Standard Chartered Saadiq Platinum Credit Card |

| University Name : | BRAC University |

| Submitted To : | G.M. ShafayetUllah |

| Submitted By : | Nazmus SaquebZuheb |

| Total Page : | 44 |

Over 60% of the bank’s profits come from the Asia-Pacific region alone, with Hong Kong playing a key role. Did you know that Standard Chartered actually issues currency in Hong Kong? That’s a rare privilege. It also has solid footing in places like China, Malaysia, Taiwan, and Thailand—especially after it took over 75% of Nakornthon Bank in 1999.

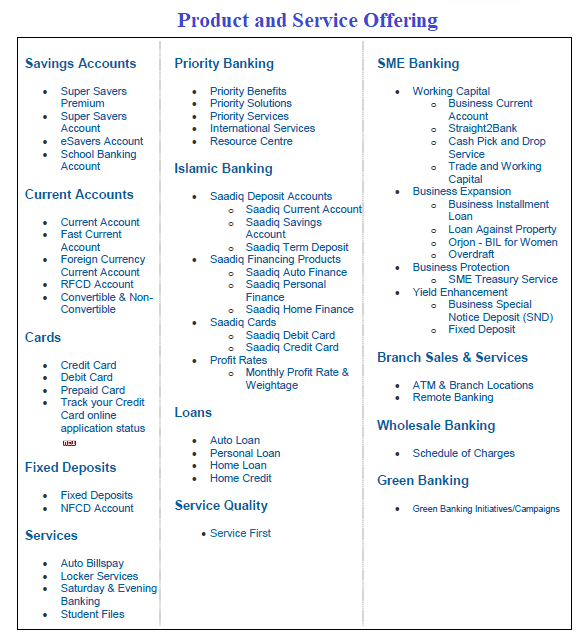

Activities of Marketing Strategy of Standard Chartered Bank

Let’s break it down. Whether you’re an individual, a small business, or a large corporation, Standard Chartered probably has something tailored for you. And that’s not just marketing talk it shows in the range of services they offer.

For Individuals (Retail Banking) of Standard Chartered Bank

- Savings and current accounts

- Term deposits and fixed options

- Debit and credit cards, including the Islamic Saadiq ones

- Personal loans, car financing, and home loans

- Priority and premium banking

- Support for students planning to study abroad

Wealth Management of Standard Chartered Bank

- Tailored investment guidance

- Insurance partnerships

- Mutual funds and forex-based investments

Corporate & Institutional Banking of Standard Chartered Bank

- Trade financing (think letters of credit, bank guarantees)

- Lending for working capital

- Treasury operations

- Currency exchange and commercial funding

Digital Banking & Online Services of Standard Chartered Bank

- 24/7 app and online banking access

- Money transfers (local & global)

- Utility and tuition bill payments

- Mobile top-ups, SMS alerts, and e-statements

- ATMs and POS network support

Saadiq Islamic Banking of Standard Chartered Bank

- Saadiq current and savings accounts

- Shariah-compliant term deposits

- Saadiq Platinum Credit Card

- Home finance under Islamic principles

- Islamic business lending

Support for SME Banking of Standard Chartered Bank

- Small business loans

- Trade finance for entrepreneurs

- Business accounts and credit/debit cards

Financial Statement of Standard Chartered Bank of Bangladesh Highlights of 2023.

In 2023, the bank’s Bangladesh wing posted a solid profit of BDT 2,335 crores. That’s not just good it’s a 41% jump from 2023. Clearly, something is working.

Annual Report of 2023 and 2024. Click here

Their complete financial breakdown includes the usual suspects: profit & loss statements, balance sheets, cash flows, auditor notes, and more. These documents are publicly accessible on their financial reports page for anyone interested.

- Smarter investment strategies

- New financing models for major projects

- Conservative risk management, paired with strong liquidity

Full Financial Reports Included.

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Notes to the Accounts

- Auditor’s Report

If you need you can download these from their financial reports page. Click here

Objective of the project:

Primary Objective

To understand how Standard Chartered promotes the Saadiq Platinum Credit Card and maintains its reputation across multiple customer segments.

Secondary Objective

Getting a feel for how a global bank operates within the local business landscape

Exploring the branding, advertising, and communication styles

Understanding their logo symbolism and color use

Suggesting room for improvement in their strategies and structure

Methodology

Research came from a blend of real-world experience and online sources.

Primary Source of Information

- Day-to-day observations during internship

- Conversations and informal chats with SCB officials

- Direct involvement in some of their internal processes

Secondary Source of Information

- SCB’s annual reports and publications

- Their social media content

- Official website: www.sc.com

Conclusion

After digging into the details, one thing is clear: banks like Standard Chartered can’t afford to coast. Customers are more informed and expect more than ever before. Products like the Saadiq Platinum Credit Card show the bank’s attempt to meet both financial and ethical expectations. At the end of the day, whether a bank thrives or fails depends on one thing—its customers. Keep them satisfied, keep them coming back. That’s not just a strategy; that’s survival.