Internship report on Recruitment & selection process of DBBL 2025, Focusing on the Gulshan Branch of Dhaka, Bangladesh. This report emphasizes on the Evaluation of the the wide scope of banking and monetary exercises to individual, firms & corporate and other international organizations just as items and administrations offered by the bank to its customers and keep to keep up the nature of administration.

A country’s economy heavily depends on remittances, which play a crucial role in boosting GDP, particularly in developing nations like Bangladesh. Remittances not only provide foreign currency but also significantly contribute to poverty reduction and economic stability.

For Bangladesh, this influx of capital is vital, as it supports millions of families and bolsters national growth. Among the financial institutions facilitating these economic gains, Dutch Bangla Bank Limited (DBBL) stands out as a leading player, thanks to its comprehensive range of services and customer-centric approach.

| Report Title : | Recruitment and Selection Process of Dutch Bangla Bank Limited |

| University Name : | Daffodil International University |

| Submitted To : | Dr. Sheikh Abdur Rahim |

| Submitted By : | Zul Asfi |

| Total Page : | 53 |

This report explores various aspects of DBBL, including its background, innovative services, customer relationship strategies, and areas for improvement. The report is structured into four chapters: an introductory chapter, an overview of DBBL’s background and history, a conceptual framework of its operational strategies, and a detailed analysis of the findings based on a three-month internship.

Background and History of Dutch Bangla Bank ltd:

Established in 1995, Dutch Bangla Bank Limited has consistently worked toward redefining the banking experience in Bangladesh. As one of the pioneers of modern banking, DBBL has introduced advanced technological solutions, such as the country’s first automated teller machine (ATM) network, which now spans over 5,000 locations nationwide.

These ATMs ensure accessible and efficient banking for millions of customers, particularly in rural areas where banking services were previously limited. DBBL has also earned accolades for its focus on corporate social responsibility (CSR).

Through initiatives in education, healthcare, and environmental sustainability, the bank has strengthened its brand image while contributing to the broader welfare of society. This dual focus on profitability and social impact has enabled DBBL to position itself as a trusted and reliable financial institution in Bangladesh.

Benefits of Banking with DBBL:

One of DBBL’s standout features is its commitment to customer convenience and satisfaction. It offers a range of benefits that cater to the diverse needs of its clientele:

- Widespread Branch Network: DBBL operates over 200 branches nationwide, ensuring that its services are accessible to customers in both urban and rural areas. This extensive network allows the bank to maintain a strong presence across the country, meeting the financial needs of individuals and businesses alike.

- Innovative Banking Solutions: DBBL is renowned for its adoption of cutting-edge technology. From internet banking to mobile banking apps, the bank provides seamless digital solutions that allow customers to manage their accounts, transfer funds, and pay bills effortlessly.

- Customer Rewards and CSR Benefits: As part of its CSR initiatives, DBBL often rewards customers who demonstrate regular savings habits or use its digital platforms. Additionally, the bank provides scholarships to underprivileged students, ensuring a brighter future for the nation’s youth.

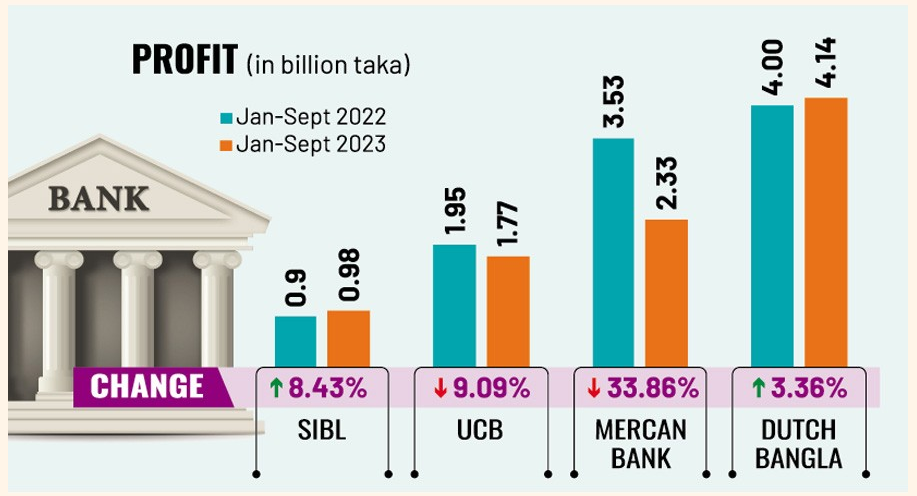

- Yearly statement published by Newsroom of Dutch Bangla Bank.

Loan Facilities of Dutch Bangla Bank ltd:

Dutch Bangla Bank Limited has recently expanded its portfolio of loan products, catering to individuals and businesses across different sectors. Its offerings include:

- Personal Loans:

Tailored for salaried professionals, these loans help customers finance personal needs, such as education, medical expenses, or weddings. - SME Loans:

Recognizing the importance of small and medium enterprises in driving economic growth, DBBL offers specialized loan products designed to support these businesses. Entrepreneurs can avail themselves of financing for equipment purchases, business expansion, and working capital. - Home Loans:

For individuals looking to invest in real estate, DBBL provides competitive home loan packages with flexible repayment options. This facility is particularly beneficial for middle-income families aspiring to own homes. - Agricultural Loans:

To support the agricultural sector, which forms the backbone of Bangladesh’s economy, DBBL offers loans tailored to farmers. These loans can be used for purchasing seeds, fertilizers, or farming equipment.

Account Opening Systems of DBBL:

DBBL’s account opening process is designed to be quick, transparent, and user-friendly. Customers can open a variety of accounts based on their specific needs, including:

- Savings Accounts:

Designed for individuals who wish to save regularly, these accounts come with attractive interest rates and easy access to funds through ATMs and online banking. - Current Accounts:

Suitable for businesses and professionals, current accounts facilitate frequent transactions with minimal restrictions. - Student Accounts:

Targeting young individuals, DBBL offers accounts with no maintenance fees, encouraging students to cultivate saving habits from an early age. - Fixed Deposit Accounts:

For customers looking to earn higher returns, DBBL provides fixed deposit options with competitive interest rates and flexible maturity periods.

The account opening process is streamlined with the availability of online application forms and minimal documentation requirements. In addition, DBBL has introduced biometric verification systems to enhance security and reduce fraud.

Findings and Recommendations:

Based on observations during the internship, several insights emerged about DBBL’s strengths and challenges. The bank has made significant strides in building strong customer relationships through its robust service delivery and wide-ranging product offerings. However, there are areas where improvements can be made to ensure long-term success:

- Customer Retention Strategies:

While DBBL has a loyal customer base, increasing competition in the banking sector necessitates a renewed focus on customer retention. Personalized banking solutions and loyalty programs could help enhance customer satisfaction. - Improved Loan Approval Processes:

Simplifying the documentation and processing time for loans can attract more customers, especially in the SME and agricultural sectors. - Enhanced Digital Services:

Although DBBL is a leader in digital banking, continuous updates and integration of advanced features, such as AI-driven customer support, can further improve the user experience. - Rural Outreach Programs:

Expanding services in underbanked rural areas, coupled with financial literacy campaigns, can strengthen DBBL’s role as a driver of economic inclusivity.

Conclusion:

Dutch Bangla Bank Limited has played a pivotal role in transforming Bangladesh’s financial landscape. Its focus on technology-driven solutions, customer satisfaction, and corporate social responsibility has earned it a prominent position in the banking sector.

However, to sustain its competitive edge, the bank must continuously innovate and adapt to the evolving needs of its customers. By enhancing its loan facilities, streamlining account services, and prioritizing customer retention, DBBL can further solidify its reputation as a trusted partner in the economic growth of Bangladesh.

- Visit for Cover page of Internship report Click here